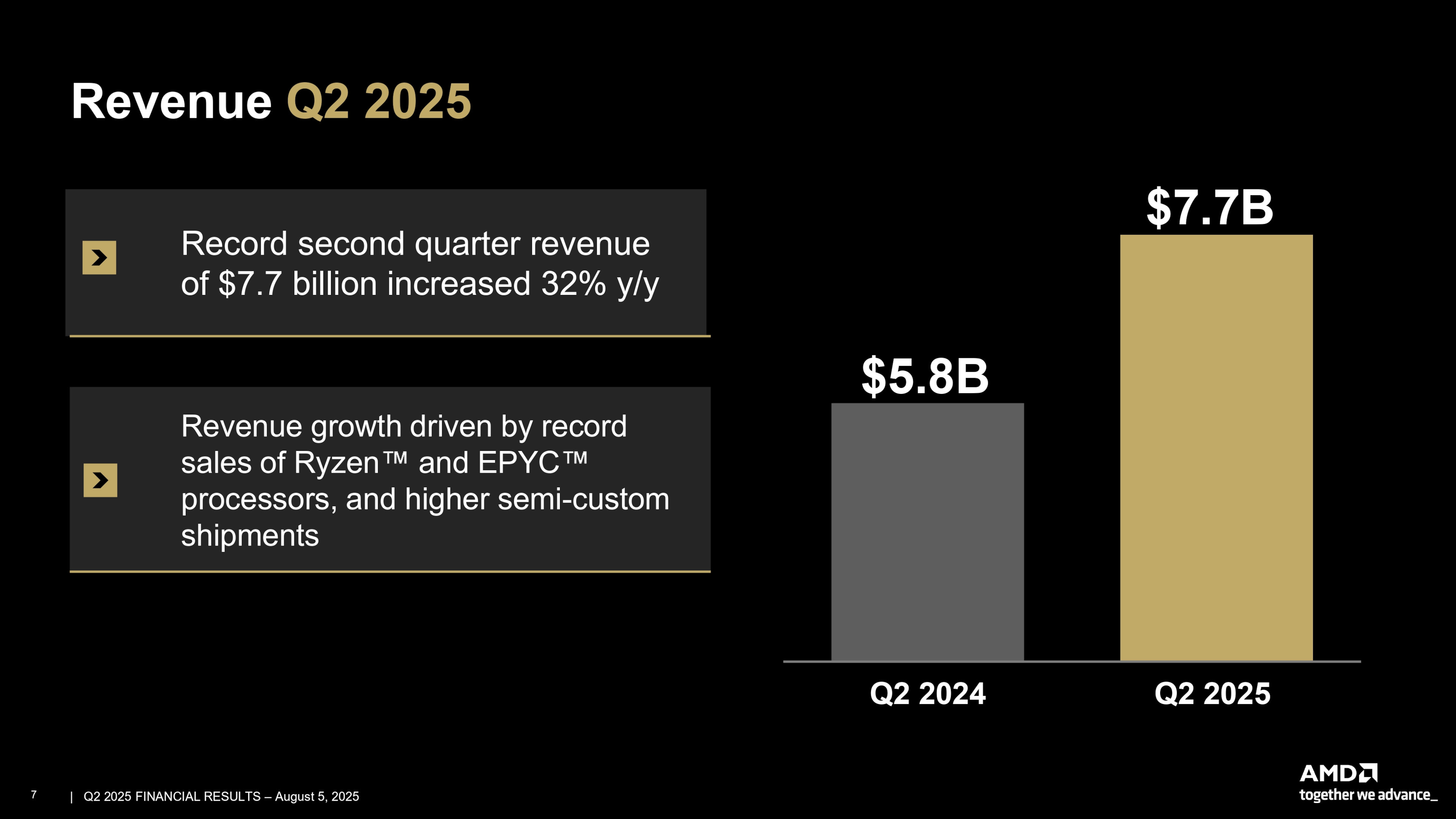

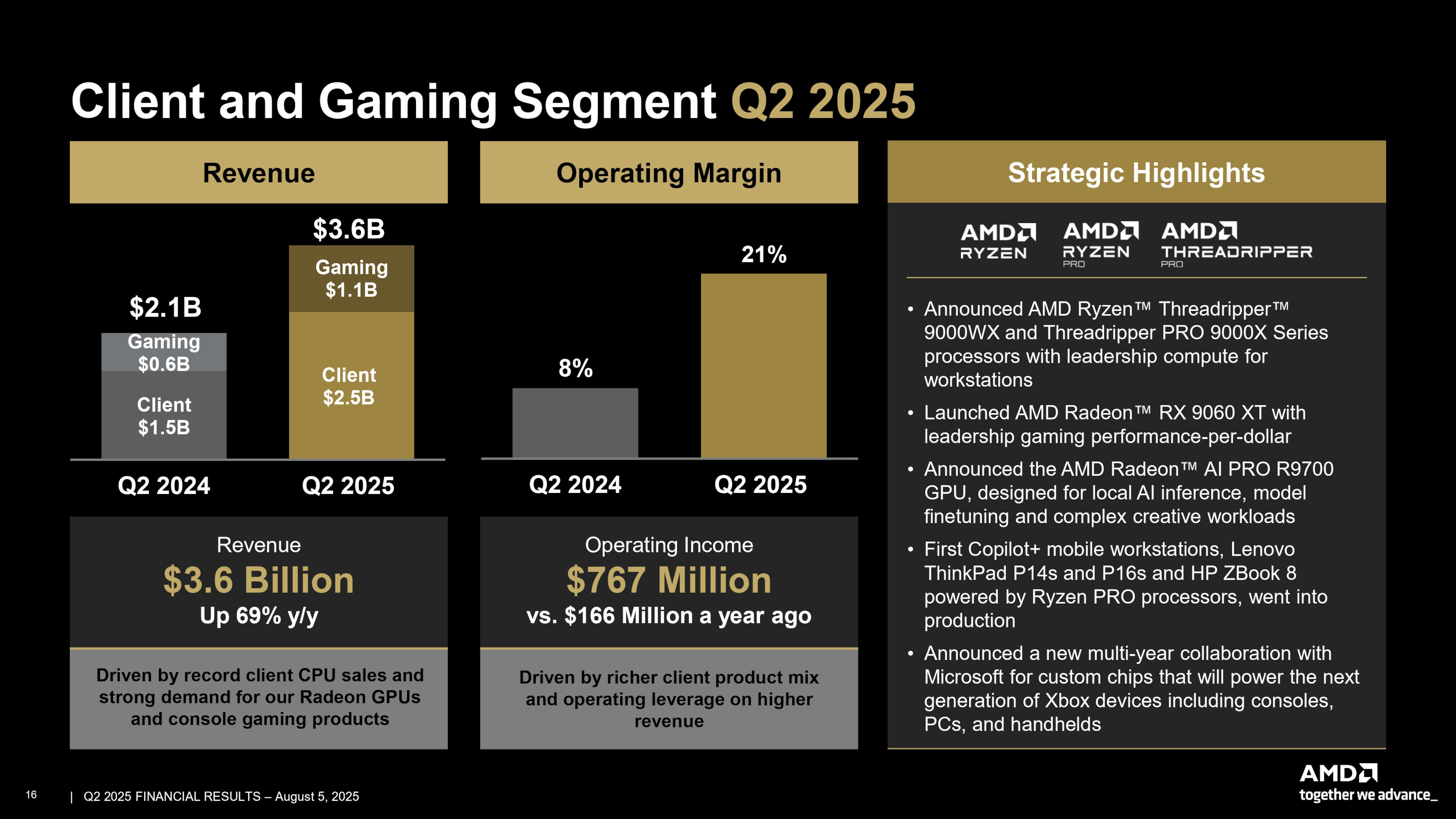

If you're a fan of AMD and its red-hued CPUs and graphics cards, you'll be pleased to know that the huge demand for Ryzens and Radeons has done w69 slot ทาง เข้า wonders for its streams of income. In its latest financial report, AMD says that its total revenue of $7.7 billion is 32% better than this time last year. However, export restrictions on its mega-bucks AI processors have resulted in its data center division making a loss for the first time in six months.

You can skim over the details yourself in the Q2 financial report summary, and at first glance, you might be puzzled as to why AMD's share prices have fallen since the release of the data.

That's booted the door wide open for AMD to stomp in, wave its chiplets about, and grab all the contracts it can.

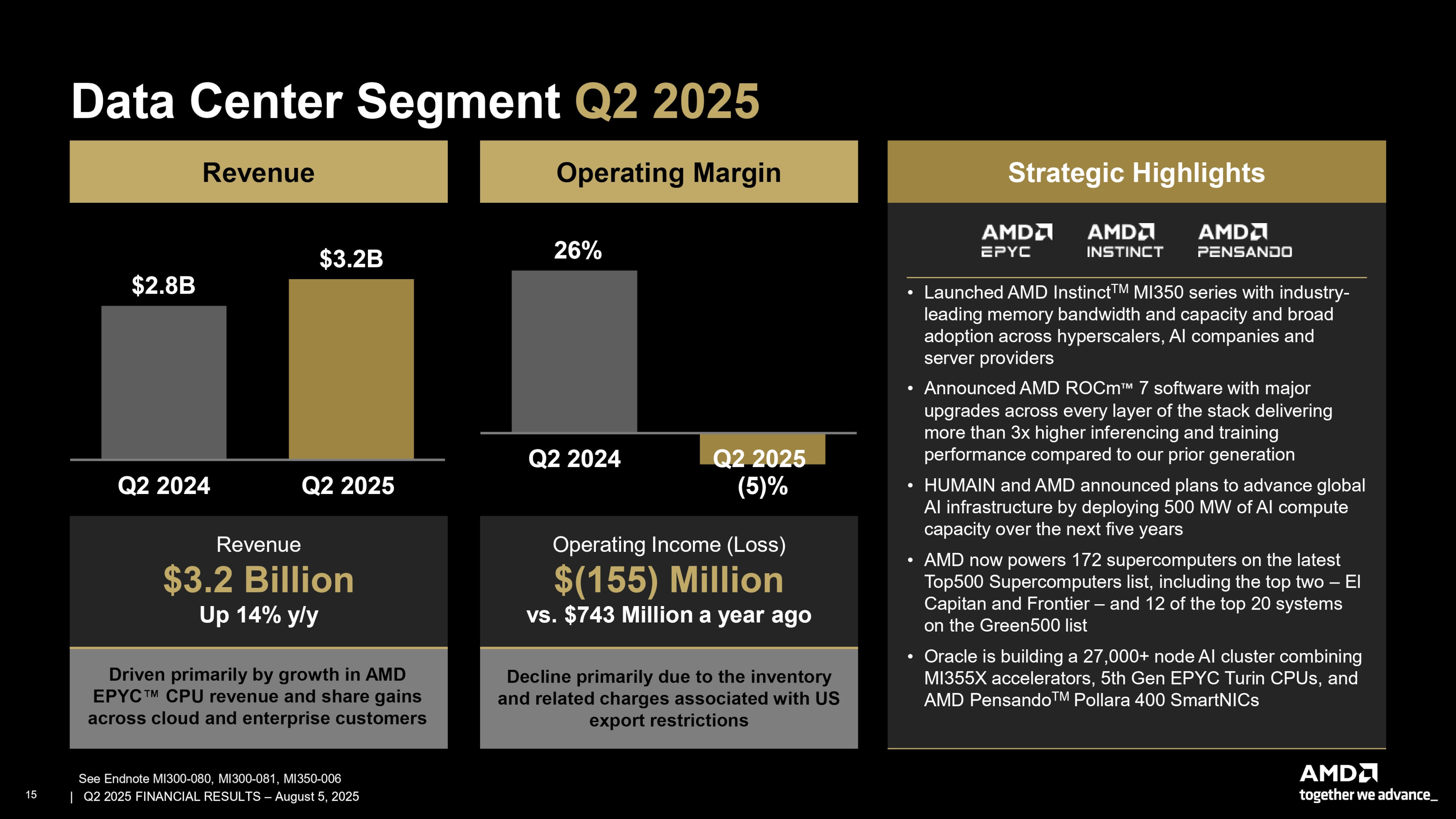

Its data center division has also enjoyed improved revenues, albeit nothing like as big a jump as with C&G, coming in at 14% better than last year. The total income was $3.2 billion, but the operating income was a loss of $155 million, in part due to US export restrictions on its MI308 data center GPUs. "These restrictions led to approximately $800 million in inventory and related charges," AMD says.

The relatively small revenue increase, the inventory cost, and the fact that Nvidia's data center revenues are in another league entirely are why AMD's shares took a small tumble after the financial announcement.

Not that this seems to be worrying Team Red in the least bit, as it expects revenues to continue improving—predicting a Q3 total of $8.6 billion—and if it can get the nod to start selling AI chips to China again, then the money is really going to start rolling in.

👉Check out our list of guides👈

1. Best CPU: AMD Ryzen 7 9800X3D

2. Best motherboard: MSI MAG X870 Tomahawk WiFi

3. Best RAM: G.Skill Trident Z5 RGB 32 GB DDR5-7200

4. Best SSD: WD_Black SN7100

5. Best graphics card: AMD Radeon RX 9070